OCR Company: Facilitating Firms with Intelligent Data Extraction

Optical Character Recognition (OCR), or digitization, have helped modern-day companies streamline their business operations, but it has also enabled fraudsters to achieve their malicious goals quickly. Maintaining trust is crucial for establishing business partnerships and availing the latest services. Intelligent solutions have smart features that initially confuse users, impacting client acceptance rates. In this scenario, financial firms must also adhere to AML/KYC regulations and strictly maintain users’ crucial data.

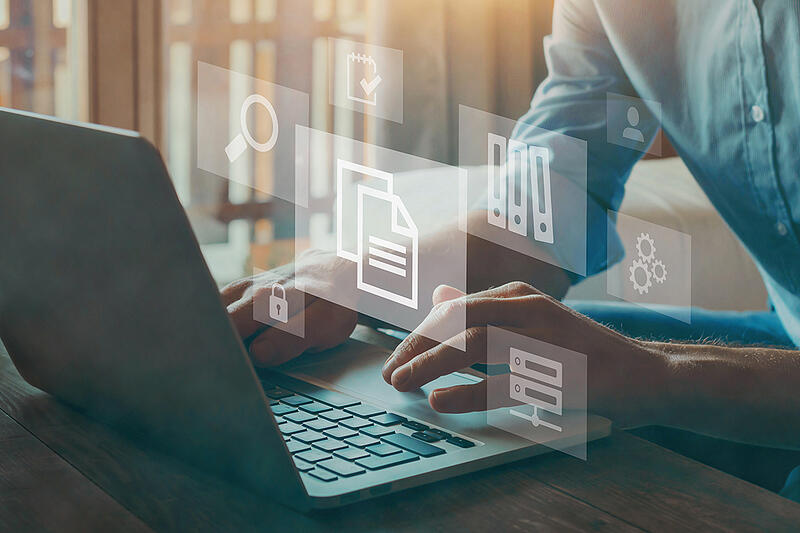

Customers’ information is vital for ID verification services, but the information acquisition process is equally significant. Collaboration with an OCR company can help modern-day organizations streamline business operations and enhance practical data extraction services.

Utilizing IDV Service as a Strict Security Protocol

Modern-day organizations opt for smart ID authenticating solutions to validate the users’ profiles for effective fraud prevention. The use of intelligent services not only streamlines customer support but also promises higher conversion rates. Efficient data extraction services with the support of an OCR company generate meaningful insights from users’ raw data for personalized services for clients.

OCR company services are highly advantageous in ensuring adherence to the latest AML/KYC standards. Integration of intelligent features with OCR solutions supports present-day companies in their business operations compared to outdated approaches. The traditional techniques were time-consuming and highly susceptible to errors. Currently, OCR solutions function in most organizations, but a poor organization of templates from multiple regions can be a big challenge. Thereupon, it can be problematic while designing profiles for users worldwide.

Enhancing KYC Checks Systems With Support From An OCR Company

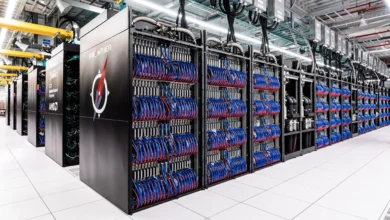

Utilizing Optical Character Recognition (OCR) services and IDV systems provides competitive customer support worldwide. Implementing an AI-driven OCR product is a pragmatic and profitable approach for modern-day industries. The latest service can efficiently process multilingual user records with the help of an intelligent template comparative analysis.

For KYC validation services, OCR systems instantly execute data extraction on consumers’ records and store them safely in industrial databases. The smart solution from an OCR company transforms data in photos into machine-readable layouts. In this light, intelligent Optical Character Recognition services can accommodate the needs of various industries regarding document ID verifications, which is another service within a KYC verification system.

Executing optical character recognition systems from an OCR company can quickly streamline the data extraction process on government-issued documentation such as rental agreements, utility bills, and university certificates. In the context of document validation systems, the OCR solutions work similarly to a Service Set Identifier (SSID) service.

Top 3 Perks from an OCR Company

Implementing Optical Character Recognition (OCR) services helps with data extraction on Machine Readable Zone (MRZ) encryptions with special characters, alphabets, and various spaces. For convenience, these codes are available at the bottom of passports which facilitates the user data comparison analysis.

Combining ID document verification services with Optical Character Recognition software helps present-day industries manage their capital. Without question, a streamlined consumer onboarding process provides a hassle-free experience to clients worldwide and strengthens relationships with users. There are various challenges that modern-day industries face while dealing with recurring tasks. In present times, customers also demand unbeatable data security via cloud storage. Hence, the utilization of OCR solutions can facilitate corporations in dealing with their challenges.

- Achieve Goals By Using AI-Powered Solutions

The AI-driven optical character recognition services from an OCR company are highly efficient than traditional data extraction approaches in the market. Modern-day corporations that do not opt for smart OCR services cannot achieve their yearly profit goals or improve customer support systems for users.

- Secure Data Against Scam Attempts

Optical character recognition services provide complete control over consumers’ data by converting it into client-friendly layouts for quick availability in. xlsx formats. In this light, companies do not have to deal with frustrating paperwork. Moreover, the system also ensures robust data security. Hence, corporations can secure users’ data without the threat of cyberattacks.

- Eliminate Human Intervention & Reduce Costs

Using optical character recognition services from an OCR company removes manual effort from the business workflow. In this light, any corporation can get the job without recruiting an employee. Utilizing intelligent systems allows any company to manage its capital smartly. Consequently, modern-day industries can optimize their expenditures hassle-free

Final Words

In present times, It is vital that businesses implement intelligent solutions for quick verification results. The innovative optical character recognition services from an OCR company can quickly work with electronic devices to generate high-quality output. The modernized systems provide better customer support and top conversion rates. According to business needs, intelligent solutions from an OCR company also modify images in the case of poor lighting. Dealing with user records is a recurring job for some industries worldwide. Consequently, an OCR solution instantly extracts data from multilingual documents with fast processing power.

James William is a technical content writer with years of experience. He’s passionate about exploring and writing about business, finance, and technologies like Artificial Intelligence, Machine learning, fintech, and cybersecurity. All of my writing follows the latest stats and trends, helping increase readers’ knowledge.